This is part 2 of Jeff Goldsmith’s history of managed care. If you missed it read Part 1

By JEFF GOLDSMITH

The late 1990s crash of HMOs opened the door to a major consolidation of the health insurance market controlled largely by national and super-regional health plans. While HMOs by no means disappeared post-backlash, the “movement” begun by Ellwood and Nixon fell far short of national reach. HMOs never established a meaningful presence in the most rapidly growing parts of the US- the Southwest, South and Mid-Atlantic regions, as well as the Northeast.

The exemplar, Kaiser Permanente, damaged its financial position with an ill-considered 1990’s (McKinsey-inspired) push to become a “national brand”. Today, over 80% of Kaiser’s 13 million enrollment is still in the West Coast markets where it began 80 years ago!

HMOs Go Public and Roll Up

Two little noticed developments accelerated the shift in power from providers to payers. One was the movement of provider sponsored health plans into the public markets. PacifiCare, the most significant hospital sponsored health plan owned by the Lutheran Hospital Society of Southern California, was taken public in 1995. A subsequent merger with FHP health plan destabilized the newly public company.

After PacifiCare crashed post the 1998 Balanced Budget Act cuts, and struggled to refinance its debt, it was acquired by United Healthcare in 2005, bringing with it a huge sophisticated, delegated risk contracting network. United then bought Sierra Health Plan based in Nevada in 2007, including its large captive medical group, its first medical group acquisition. Following these acquisitions, United rolled up PacifiCare’s southern California based at-risk physician groups in the late 00’s, and then capped off with its purchase of HealthCare Partners, the largest of all, 2017 from DaVita in forming the backbone of today’s $110 billion Optum Health.

United’s buying BOTH sides of the delegated risk networks-plan and docs-in high penetration managed care markets is not fully appreciated by most analysts even today.

It has meant that as much as 40% of Optum Health’s revenues, including almost $24 billion in capitated health insurance premiums, come from competitors of United’s health insurance business.

However, of greater strategic significance was Humana’s decision in 1993 to exit the hospital business by spinning its 90 hospitals off as Galen.

Humana’s unsentimental founders, David Jones and Wendell Cherry, concluded that the intense physician push back against their growing health plan meant that their two business were fundamentally incompatible, and they chose to retain ownership of the higher margin and less complex business.

Galen hospitals began a lengthy and sad journey through multiple owners-Rick Scott’s ill-starred Columbia/HCA, Tenet, and then multiple others. Today, Humana is the second largest “player” in the Medicare Advantage market, and had a market cap north of $60 billion (until a month or so ago).

HIPAA Sets Stage for 24/7 Electronic Surveillance of Medical Decision Making

The other little remarked development provided the technical foundation for a payer controlled care system- the Health Insurance Portability and Accountability Act of 1996 (HIPAA). Up until the mid-1990s, healthcare claims were paper and fax transmitted, costly and unreliable. Though HIPAA is mainly known for its confidentiality protections for patient data, its Administrative Simplification provisions set data standards to encourage electronic submittal and payment of medical claims.

HIPAA encouraged the emergence of electronic data interchange through dedicated T-1 lines, hardwired ancestors of today’s VPNs–high capacity, secure physical links between hospitals and their major payers. HIPAA markedly accelerated the use of electronic data interchange (EDI) in healthcare, to the great advantage of health insurers.

HIPAA spawned a whole ecosystem of small companies who served as financial intermediaries between health insurers and care providers–aggregating, transmitting and processing medical claims and paying providers for their care. These companies proliferated during the first Internet investment bubble, which began after Netscape’s historic IPO in 1995. When the Internet bubble burst in 2000, these companies were sold by their private equity and venture owners in an ensuing multi-year fire sale.

PPO Growth Burns Down the Commercial Rate Structure

While the HMO movement faltered, provider-centric delegated-risk capitation gave way to broad panel “preferred provider organization” (PPO) managed care which paid physicians and hospitals a discounted fee-for-service, and overlaid external utilization controls like prior authorization. The PPO movement markedly diluted physician economic power. PPOs were basically an industrialized version of traditional Blue Cross, only without physician or hospital governance input.

PPO health plans threatened to exclude local providers that did not grant them significant discounts. Independent physicians had zero leverage in this transaction. Hospitals who discounted their rates in the panic to avoid being excluded discovered that their pricing concessions yielded no growth in volume or market share, just reduced revenues. This late 1990s pricing panic burned down hospital commercial rate structures in the West and Southwest, as far east as Chicago, Minneapolis and St. Louis, and accelerated the trend to system consolidation.

The ObamaCare Festival of Technocratic Enthusiasm

At the same time, Medicare moved aggressively to get providers into a new, less politically inflammatory version of managed care for large regular Medicare market (e.g. the non-Medicare Advantage portion). The 2010 Affordable Care Act’s main event was to expand health coverage to the working poor through a partial nationalization of the individual insurance market and an aggressive expansion of Medicaid. This coverage expansion was a huge success, bringing new coverage to 30 million Americans.

But in a muted afterthought, recognizing continuing health cost pressure, ObamaCare also sought to revive, for one last time, for regular Medicare, the Ellwood/Enthoven vision of a transformed, at-risk care system. Having concluded that the closed panel, capitated integrated care system model could not be reached in a single impossible transformation, as the Clintons attempted and failed to do, it would sow the seeds of capitation through a “managed care” lite model called Accountable Care Organizations.

There were two ACO concessions to the post-HMO backlash environment. First, Medicare patients were not forced into managed care plans (or even told they were in them), and providers would be insulated from downside financial risk for a lengthy period. ACO membership was a statistical construct, not a consensual patient panel; patients would be assigned to ACOs if their primary care physicians participated. The lack of patient choice violated a key principle of the Ellwood/Enthoven model, in which patients would choose systems of care and reap a financial reward for making the “right choice”.

The second was that providers would continue to be paid Medicare’s fee for service but a shadow accounting system would track ACO spending. If ACO spending fell below growth in regional Medicare spending, providers would get a bonus. They would also be required to track dozens of “quality” measures and get a small bonus if they exceeded norms. The late Uwe Reinhardt pricelessly characterized “value based payment” as “fee-for-check-the-box. . . for tips” . ACOs unfolded as managed care without the risk, training wheels for a later shift to capitation.

Large commercial health plans serving employers shadowed the Medicare ACO program, taking advantage of yet another hospital pricing panic based on deeply discounted rates. Many of the plans offered under ObamaCare’s insurance exchanges were of this type. While it was assumed by providers that commercial ACOs would move rapidly toward true delegation of risk, a decade on, the risk mysteriously has not passed over to providers, who have spent at least $10 billion preparing for ACOs. Physician time in helping manage ACOs and in minutely documenting all those “core measures” is invariably costed at “zero”.

If one counts the bonuses paid out to successful ACOs, the cost overruns by the ACOs that missed their cost targets on the high side, and the cost to Medicare of setting up, administering and monitoring them, the program has yet to reach breakeven. Paid out bonuses tended to be highly concentrated in those fortunate ACOs operating in high Medicare cost markets. To no one’s surprise, physician-sponsored ACOs (facilitated by a lucrative industry of organizers and contracting consultants) have decisively outperformed those sponsored by hospitals.

Today, perhaps 14 million regular Medicare beneficiaries are in some form of ACO, largely without their own knowledge. MedPac has characterized Medicare’s ACO program as a “disappointment” and a recent NEJM article by a former head of the Center for Medicare and Medicaid Innovation (CMMI) found that only 5 of the 59 payment experiments by the agency had actually saved Medicare money. If the ACO was intended as a bridge to a “multiple Kaisers in regional markets” health system, it is a bridge to nowhere.

However, as an “industry”, the ACO movement has been an incredible success. The post-ACA push to ACOs created one of the most lucrative consulting franchises in the last forty years. Wags said ACO stood for “Awesome Consulting Opportunity”. And private equity facilitators of ACO participation such as Evolent, Aledade, Agilon and Privia have unicorn level market caps and are being shopped by private equity owners and bankers to would-be healthcare disrupters. To echo a Wall Street wag, one wonders where are the patients’ and physicians’ yachts.

All the while, the untransformed regular Medicare program has been eclipsed by Medicare Advantage, which employed private health plans to organize and manage Medicare services for, what is today, well more than half of Medicare’s 66 million beneficiaries. This program has been captured by a handful of large commercial insurers, two of whom–Humana and United Healthcare–control almost half of MA’s 33 million beneficiaries, and is by far their most profitable line of business.

Actual Capitated Risk for Providers has been in Scarce Supply

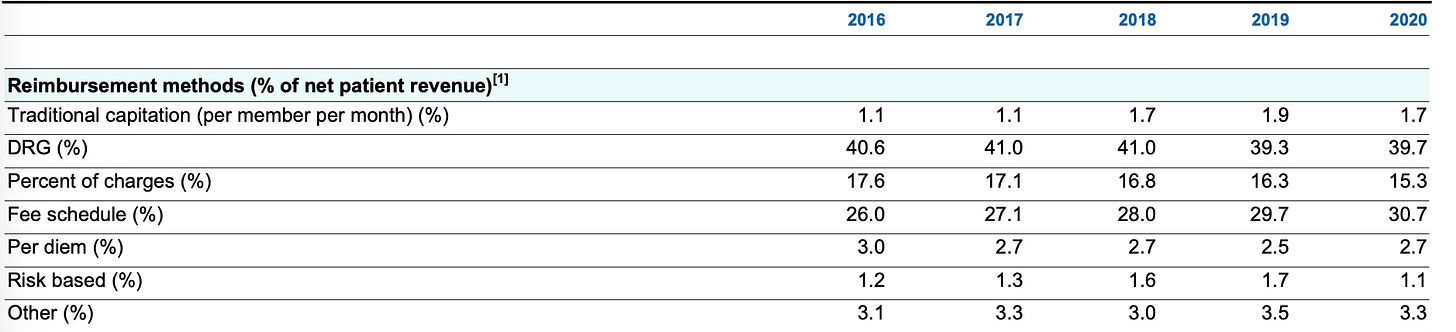

However, these large commercial carriers have been disinclined to share their risk (and profits) with care providers. Moody’s Investor Service found that the median US hospital received only 1.7% of their revenues from capitation, and another 1.1% from “two-sided” ACO style risk in 2020, up from 1.1% and 1.2% respectively in 2016.

Hospital Revenue Sources: Median Values

Source: Moody’s Investor Service, 2021

By 2013, capitation as a percentage of primary care office based income had fallen to only 5% from 15% mid the previous decade, according to HHS analysts. Current two sided risk income for physicians is unknown to this analyst, but is believed to be negligible.

Stay tuned for Part III of this Managed Care History where we focus on the transformation of managed care into a machine and algorithm driven surveillance system for physicians and hospitals.

Jeff Goldsmith is a veteran health care futurist, President of Health Futures Inc and regular THCB Contributor. This comes from his personal substack